Donna Motley, Vice President of Claims

Owning and operating a business is multi-faceted. Having Workers’ Compensation insurance, required by law, is one of those many facets. Hopefully, most employers rarely have to utilize their Workers’ Compensation insurance. BUT, should an employee be injured in the course of employment, you, as the employer need to be prepared.

So how far does the employer’s responsibility reach? The employer is responsible for providing a safe working environment, for training employees in the proper way to perform their job, for proper machine and facility maintenance and for properly handling a work related injury, should one occur. An employee injury is costly in many ways. An injured employee is affected professionally and socially. The employer’s production and work product is affected. A work injury has a financial impact on everyone involved. The employer has a vested interest in making the employee be the best he/she can be, as the employer will reap the rewards.

Don’t ignore the signs. If a Supervisor walks past a work station and notices an employee stretching their back, rubbing their shoulder or playing “windmill” with their arms, that should be the employers first clue that something may not be right. Ignoring “signs” rarely benefits the employer. It is doubtful the situation will resolve itself or just “go away”. On the contrary, what usually happens is the employee will start treating with their primary care physician for the medical condition. Then when it starts to cost the employee a lot of money, or the condition does not resolve, or someone tells them they should file a Workers’ Compensation claim, the employee will bring the situation to the attention of the employer. By this time, treatment has been rendered and we would have to obtain all those medical records; suspicion overshadows the entire claim because it is being reported so late and after the employee has received treatment; and we will not allow treatment until the matter has been investigated. This delay in treatment will in turn delay the employee’s recovery and impact work product and production.

While we are not suggesting that a Supervisor “suggest” to an employee that the employee has a work injury, a simple “Is everything o.k.? I noticed you rubbing your shoulder” can go a long way. At that point the employee may admit that he has an injury that occurred outside of work (make note in the personnel file if that is the case); the employee may alert the employer to a machine set up or situation that could maybe be changed to be more ergonomic; and the employee may come away feeling their employer “cares”.

If the employee advises that something he did at work has caused an injury, the employee should be immediately sent to the clinic. Remember, it is not up to the employee to decide whether or not they “want” to go to the clinic if they have reported a work injury. Whether the employee alleges nothing is wrong, an injury occurred outside of work (i.e. they just slept wrong) or there was a work incident, the Supervisor should follow up with the employee later that day, the next day and the next week, and ask if everything is o.k. or if they are having any other issues. Again, ignoring these situations do not make them go away – instead, they tend to “fester”.

As an employer, you should review all employee injuries, your injury logs and/or loss runs to determine how many and what kind of injuries are occurring and where they occur. Then review to see if there are any changes that could be made so injuries do not continue. Your Loss Control Consultant can be a tremendous help in this regard. Remember, we are a team, all working toward the same goal – a safe and productive work environment! We all benefit!

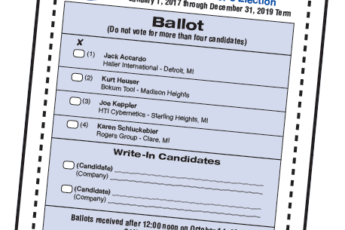

In January our CFO will put together the 2016 numbers and will also get the loss trend analysis from our independent outside actuary. With all of this data, the MTM management team will prepare MTM year-end financials for presentation to the MTM Board on February 16th. Included in that presentation will be member dividend data and options for the Board to consider and ultimately decide. MTM members are well represented by the Board since all Board members are MTM insureds.

In January our CFO will put together the 2016 numbers and will also get the loss trend analysis from our independent outside actuary. With all of this data, the MTM management team will prepare MTM year-end financials for presentation to the MTM Board on February 16th. Included in that presentation will be member dividend data and options for the Board to consider and ultimately decide. MTM members are well represented by the Board since all Board members are MTM insureds.

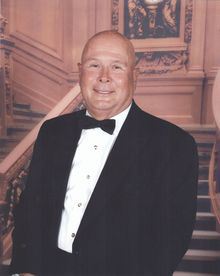

The Hancock legacy began with John Hancock Sr. who in 1939 started Crescent Tool and Die and has been with MTMIC for 40 years. That decision 4 decades ago was made by John Hancock Sr. who joined a group of bold shop owners to start and support their own insurance company. Their goal was to improve loss control efforts for their shops and hence the long term availability and pricing. Saving money for members was the focus of the group.

The Hancock legacy began with John Hancock Sr. who in 1939 started Crescent Tool and Die and has been with MTMIC for 40 years. That decision 4 decades ago was made by John Hancock Sr. who joined a group of bold shop owners to start and support their own insurance company. Their goal was to improve loss control efforts for their shops and hence the long term availability and pricing. Saving money for members was the focus of the group.