Often I have stated that the strengths of MTM are based on three pillars:

- A Board made up of members (Board is directly focused to member benefits/improvements),

- Professional long-term committed staff members,

- Members who support employee safety and save money through loss control efforts.

Last month I profiled one of our MTM members, Avalon & Tahoe Mfg. Inc. This month I have the honor of introducing two new MTM Board committee members.

Brady Schlesener – Director of Sales and Marketing, Gemini Group, Inc.

Brady Schlesener – Director of Sales and Marketing, Gemini Group, Inc.

Brady is a graduate of Cedarville University with a BA. He then went

on to receive his MBA from Michigan State University. For the last 12 years, he has been an executive at Gemini Group, Inc.

Brady is a team player with great functional experiences – perfect fit for our MTM Board Marketing & Underwriting Committee.

Our second new Board committee member is Barry Kavanagh FCCA, CMA, VP of Finance at Avalon & Tahoe MFG, Inc.

Our second new Board committee member is Barry Kavanagh FCCA, CMA, VP of Finance at Avalon & Tahoe MFG, Inc.

Barry received his BA from Waterford Institute of Technology in his native Ireland. He is a Fellow of the Association of Chartered Certified Accountants (ACCA), the main accountancy body in the UK, Europe and Asia, and holds the Certified Management Accountant certification from the U.S. Institute of Management Accountants.

For five years, Barry has been the VP of Finance at Avalon & Tahoe MFG. Inc. Prior to that Barry was the Controller at another MTM member for over eleven years. With Barry’s financial skills and his 12

year history working with MTM, he is also a perfect fit for the MTM Board Finance committee.

Thanks to these new Board committee members, I am anxious to see how they contribute to the committee’s and MTM’s success. Brady will be working with Chairman Brad Lawton, Star Cutter Company. The Board Finance Committee is chaired by Teena Kowalski.

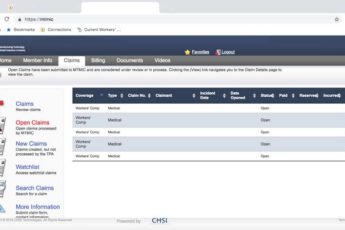

As we visit your shops, we are finding nearly every shop has a hiring sign in the window. This year we are seeing more accidents from low experienced individuals who may have gotten less training than desired. Our members focus on keeping employees safe. It is that important third leg of the MTM success stool. As always, we will keep our Loss Control Representatives busy visiting your shops, giving advice and doing anything that will help improve the safety of our member’s employees.

Until next time, be safe.

Brady Schlesener – Director of Sales and Marketing, Gemini Group, Inc.

Brady Schlesener – Director of Sales and Marketing, Gemini Group, Inc. Our second new Board committee member is Barry Kavanagh FCCA, CMA, VP of Finance at Avalon & Tahoe MFG, Inc.

Our second new Board committee member is Barry Kavanagh FCCA, CMA, VP of Finance at Avalon & Tahoe MFG, Inc.