On February 21, the MTM Board of Directors with management reviewed 2018 financial results. This meeting took place after the Board Marketing and Board Finance Committees had weighed on this issue two weeks earlier. At the end of the Board review, they approved three member dividend declarations. The first dividend was $1.6 million to be shared by all MTM members.

The second declaration was an additional $2.4 million dividend to be shared by MTM members that had a loss ratio lower than the company’s average loss ratio for three years. In the third declaration, the Board approved a new dividend of about $450,000 to newer MTM members to bring them into the dividend cycle sooner than has been in the past.

(more…)By Chris Demeter, Senior Loss Control Consultant

If you have been a frequent reader of our monthly newsletter over the years, you know we have showcased a couple times the Alliance MTMIC has with MIOSHA CET. We have one of the longest running Alliances, 13-years and going strong. Every three years the Alliance has to be renewed. This year the renewal signing was done at the MTMIC office. After each renewal signing, MIOSHA releases a press release announcing the signing. Below is the press release along with a couple pictures.

To learn more about the free consultation and training services MIOSHA CET offers, see the following link: https://www.michigan.gov/documents/dleg/wsh_ cet0165_216929_7.pdf

MTMIC members who are interested in setting up free MIOSHA CET services at your facility (e.g. air or noise monitoring, hazard survey or training) contact Chris Demeter, MTMIC Alliance liaison, at 517.230.0937 or by email at chris.demeter@mtmic.com/blog. Chris will submit a request for consultative assistance (RCA) form on your behalf.

(more…)January is a busy month for MTM Management. Nearly half of all MTM members have policies that renew in January. Also in January the MTM Accounting people are busy working with our outside actuary to close and determine the results for 2018. In 2018 we had two fatalities. In an average year our members have two amputations. That’s what it was in 2017, and in 2018 we had seven amputations. During the year, these results were concerning, and we asked the MTM loss control staff to give more focus to this area with our members. Not only do these severe accidents have a dramatic impact on the worker and their families, but it also is hugely disruptive to the shop and the remaining staff. Loss Control people, as they visit you, will be paying special attention to lock out/tag out procedures and electrical connections.

With this increase in severity drawing our focus, we found some good news, too. The good news is that the average frequency of normal accidents was less. That is some of the increase in severity is offset by reduction in normal accidents. So with a drumroll, in February management recommended and the MTM Board committees and the MTM Board approved a $4.5 million dividend to MTM members. This equals 25% of the current premium. This is also the fifth year in a row where member dividends have been paid. Like past years, the dividend is made up of parts. Part one is a $1.6 million loyalty dividend, which is split amongst all MTM members.

All State & Federal Labor Law Posters have been mailed out to all of our companies, as well as updated minimum wage information and the new Paid Medical Leave Act details. If you have NOT received yours please contact Patty Allen (patricia.allen@mtmic.com/blog) who will get a replacement set mailed out to you.

Mark your calendars now so you do not miss our 2019 Annual Meeting! Join us October 17, 2019 at the Inn at St. Johns in Plymouth, Michigan.

If so, you should sign up for AutoPay! We divide your annual premium into twelve monthly payments and automatically pull the money from your checking account on the due date, saving you time, postage, and fear of your payment being late. If you are interested you can contact Chris Doebler at chris.doebler@mtmic.com/blog or Glenda Moyle at glenda.moyle@mtmic.com/blog. Already into your policy year? We can take the rest of your scheduled payments via AutoPay at your request!Another option is to pay the year in full up front. Not only will you receive a 3% discount on your annual premium but you don’t have to worry about making any monthly payments. You can make your payment by check or via AutoPay.

This time of year with so many renewals in January, one of the top three questions is “I don’t understand my experience modification.” It is a topic I have covered once or twice in the past, but a refresher course might be helpful. First, the Michigan Workers’ Compensation experience mod is an individual experience modification that is based on each company’s loss experience. Six months after every policy expires, Michigan Workers’ Compensation insurance carriers are required to submit payroll by class code and loss details for every policy that they write. This information is analyzed at a rating bureau, the Compensation Advisory Organization of Michigan (CAOM), and a single experience modification is published for every employer. A handful of exceptions exist such as large self-insured employers. But the vast number of employers have a standard Workers’ Compensation experience modification that is used by all carriers.

(more…)Three important items to update you on:

- You are probably well aware of our partnership with Michigan Manufacturers Association (MMA) which began July 1, 2018. We have had many joint events and announcement mailers. In November MMA held its Annual Awards Ceremony. This dress-up event had 300 professionals in attndance. Our own Megan Brown, MTM VP of Sales & Marketing presented the MFG Emerging Leader award. There was also a fun award for “the most interesting thing made in Michigan”. Lots of cool stuff. One item was the gorgeous stainless steel pontoon boats made by Avalon & Tahoe. You may recall I highlighted this company/product just a couple months ago. It was hard to pick a winner, but the final tally went to a 115 year old company in the U.P. that makes the historic Stormy Kromer hats. MTM was honored to participate in this gala event. I recommend putting this event on your calendar for next November.

- Another important item, about half of MTM members renew their coverage in January. The MTM staff has been working hard gathering updated payroll data, state experience modifications, claims and Loss Control information to prepare these members’ renewals. Except for a handful, all have been delivered. Please call us or your agent if you have any questions on your renewal.

- Lastly, but probably the most important, the MTM Finance Committee and MTM Board of Directors reviewed 2018 preliminary financial data. On December 14th, a resolution was passed that a dividend of $3.5M be returned to members. This dividend is paid in March of 2019 to members with active policies on February 21, 2019. This is the 5th year in a row of MTM dividendsUntil next time, please enjoy family and friends during this holiday season.

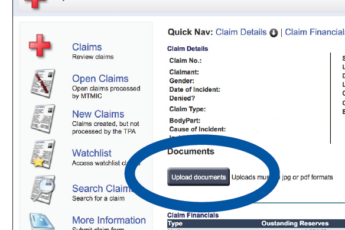

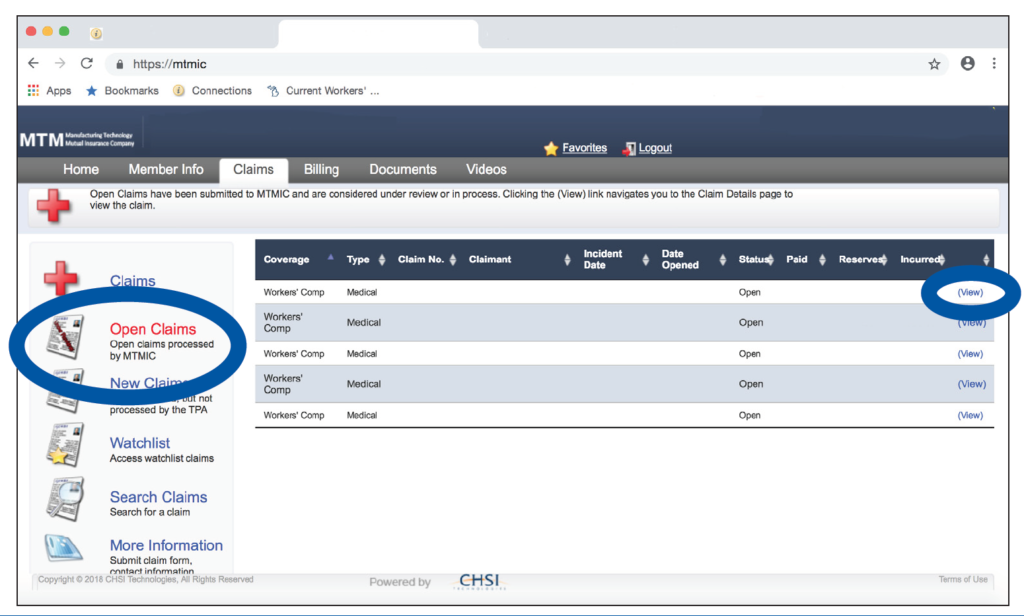

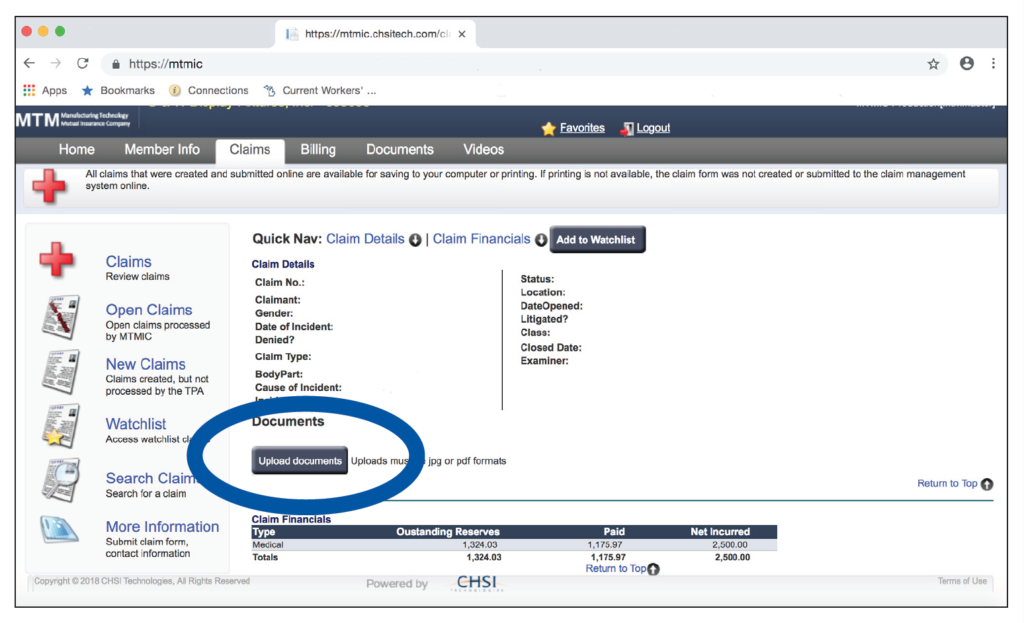

We are excited to announce that we have enhanced our customer portal so that you will now have the ability to upload medical documents as a means to get them to the claims adjuster that is handling your claim. This can be done by following these simple steps:

- Log into the portal

- Go to the claims tab

- Click on the open claims tab

- Look up the name of your injured employee

- Click the Upload Documents button and attach the documents in either a .pdf or .jpg format

As soon as the documents are uploaded, the claims adjuster assigned to the claim will receive an alert that there is medical documentation waiting for them. You will be able to view the documentation after it is uploaded. Please contact Patty at (248) 715-0013 or patricia.allen@mtmic.com/blog with questions.

On Thursday, October 18th, MTM held its annual membership meeting. (Pictures are included in the newsletter.) At each MTM annual member’s meeting we try to spend most of the time relaying helpful information to our members. This year, that topic was active shooter and crisis management (Crisis Recovery after Active Shooter and Traumatic Events). Given all the things we’ve read and heard in the last couple of years on this topic, it seemed wise to have a professional in this field present toMTM members. The speaker was Dr. Ken Wolf who consults on workplace violence, active shooter survival, crisis management strategies and downsizing reductions in force. His resume is quite impressive and details his work in many crisis situations. Dr. Wolf assisted the US Army on-site at Ground Zero after the terrorist attacks, assisted following the mass shootings at the United States Post Office in Royal Oak (1991) and Dearborn (1993). He also responded to the Northwest Air disasters #255 (1987), #299 and #1482 (1990). Dr. Wolf assisted Ryder System and the UAW – GM after the Oklahoma City Terrorist bombing. He has been a news analyst for the Detroit affiliates of ABC, NBC and CBS. In the reviews of his presentation, the common topic critique included: learned lots, time well spent, can we have him back for more? His presentation was educational, interesting and at times scary. The topic and presentation captivated your attention.

Dr. Ken Wolf

While most of the meeting was spent on the above topic, I did give a quick nine month financial/dividend view of 2018. The year is not over and good/bad things can still happen, with nine months we are starting to get a pretty good picture of how the year’s finances/losses are doing. Overall, the results are not on pace for the record year of 2017, but 2018’s results still look good. And only two months to go before we close the year.

The loss year does look different than 2017. While the accident frequency in 2018 is nearly the same as recent prior years, we are seeing an increase in accident severity. Just in the last couple of weeks, we had an electrocution, an employee on his first day with an amputation, and third, a second amputation in the same week which required an air lifting to a trauma center. In the third case, we found in the accident investigation the employee had developed a creative way to bypass the tag out switch. So, my request to you as owners and managers of all our shops, please focus on guarding, looking for creative tag out measures, and training of new employees. Your goal, like ours is to always send the employee home in the same condition as they arrived. Be safe, John

The 2018 Annual Meeting was a great success. Here are a few snapshots from the event:

[rev_slider alias=”2018-meeting”]

We are excited to announce that we have enhanced our customer portal so that you will now have the ability to upload medical documents as a means to get them to the claims adjuster that is handling your claim. This can be done by following these simple steps:

Often I have stated that the strengths of MTM are based on three pillars:

- A Board made up of members (Board is directly focused to member benefits/improvements),

- Professional long-term committed staff members,

- Members who support employee safety and save money through loss control efforts.

Last month I profiled one of our MTM members, Avalon & Tahoe Mfg. Inc. This month I have the honor of introducing two new MTM Board committee members.

Brady Schlesener – Director of Sales and Marketing, Gemini Group, Inc.

Brady Schlesener – Director of Sales and Marketing, Gemini Group, Inc.

Brady is a graduate of Cedarville University with a BA. He then went

on to receive his MBA from Michigan State University. For the last 12 years, he has been an executive at Gemini Group, Inc.

Brady is a team player with great functional experiences – perfect fit for our MTM Board Marketing & Underwriting Committee.

Our second new Board committee member is Barry Kavanagh FCCA, CMA, VP of Finance at Avalon & Tahoe MFG, Inc.

Our second new Board committee member is Barry Kavanagh FCCA, CMA, VP of Finance at Avalon & Tahoe MFG, Inc.

Barry received his BA from Waterford Institute of Technology in his native Ireland. He is a Fellow of the Association of Chartered Certified Accountants (ACCA), the main accountancy body in the UK, Europe and Asia, and holds the Certified Management Accountant certification from the U.S. Institute of Management Accountants.

For five years, Barry has been the VP of Finance at Avalon & Tahoe MFG. Inc. Prior to that Barry was the Controller at another MTM member for over eleven years. With Barry’s financial skills and his 12

year history working with MTM, he is also a perfect fit for the MTM Board Finance committee.

Thanks to these new Board committee members, I am anxious to see how they contribute to the committee’s and MTM’s success. Brady will be working with Chairman Brad Lawton, Star Cutter Company. The Board Finance Committee is chaired by Teena Kowalski.

As we visit your shops, we are finding nearly every shop has a hiring sign in the window. This year we are seeing more accidents from low experienced individuals who may have gotten less training than desired. Our members focus on keeping employees safe. It is that important third leg of the MTM success stool. As always, we will keep our Loss Control Representatives busy visiting your shops, giving advice and doing anything that will help improve the safety of our member’s employees.

Until next time, be safe.

Thurs., Oct. 18 • 11 a.m. – 2 p.m.

The Inn at St. John’s

It is almost time for the MTMIC Annual Member Meeting and there is still time to RSVP if you haven’t already done so. Contact Patty Allen at patricia.allen@mtmic. com by October 10th so that you don’t miss out on our Crisis Recovery after Active Shooter and Traumatic Events presentation provided by Kenneth Wolf, PhD.

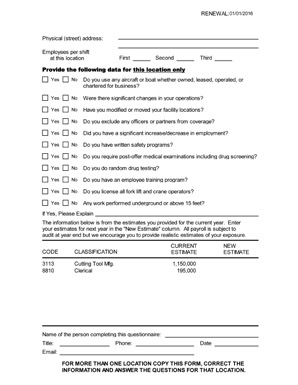

Payroll renewal forms have been sent out to all insureds that have an effective date in January 2019. We are asking for your estimated annual payroll for 2019 which assists in reducing the chance for additional audit money due at the end of your policy. Please complete

the form and return it to Glenda Moyle or an additional copy can be requested at glenda.moyle@mtmic.com/blog.

By Glenda Moyle, Premium Accounting Manager

Each year we evaluate officer coverage and rating rules. Currently, officers are included in your Workers’ Compensation calculation with a minimum payroll amount of $20,800 and a maximum of $45,000 each.

Effective 1/1/19 or later the minimum payroll amount for an officer is $26,000 and the maximum included will be $50,000.

These new amounts will automatically be applied to renewals effective 1/1/19 and after. If you have any questions, please contact me at glenda.moyle@mtmic.com/blog.

I have mentioned in previous newsletters that the best part of my job is delivering member dividend checks in March. I have also said the second-best part of my job is going to and touring MTM member’s facilities. One MTMIC member that makes a particularly interesting product is Avalon & Tahoe.

You probably have heard the name before, but if not, they build pontoon boats. Before my tour, my image of a pontoon boat was anything but sleek, plush, and cool. My tour was arranged by Avalon & Tahoe’s CFO, Barry Kavanagh. Mr. Kavanagh handed me over to their plant Operations Manager, JJ Dudick. This tour changed my vision completely. Before getting to that, let me tell you what their brochure says, and now with the tour knowledge in hand I can say these statements are very accurate.

At a recent MTM Board meeting, I was asked for a “wrap up” report from the spring dividend. It was the normal report with management members, but one set of numbers is worth sharing with our members. The question was how does the MTM dividend compare with similar and competing mutual insurance companies with special focus on mutual companies. Here was what was reported to the Board:

MTM returned 83.4% of its 2017 profit as member dividends. We reviewed 3 well-known companies to provide the following comparison. Company A, a nonmutual returned 7.6% of its profit as member dividends. Mutual competitor number one returned 18.9% while mutual company number two returned 5.3%. The MTM member owner dividend is in a completely different ballpark compared to commercial carriers, and even other mutual companies. These numbers prompted a whole different conversation of why MTM is so different.