January and February are an important time for MTM staff. It’s when we put together all the documentation that leads up to the printing of member dividend checks in March. Let me give you a rundown of what happens. On New Year’s weekend, Chris Doebler our 28-year veteran CFO puts together all of the claims detail and payroll information for 2023. This immense amount of detail is sent to an outside actuary to do loss valuations required by the Michigan Insurance Department. This review takes close to three weeks by the outside actuarial firm.

On January 29th Chris Doebler, Megan Brown, our VP of Sales/Marketing, and myself head to Nashville to meet with our actuarial advisors to discuss the results. We review the 110-page document to evaluate the proper reserves that are necessary to make sure that all the money necessary to pay those claims is put away. It is a challenging balancing act with the legislative and judicial changes, inflationary impact, and the loss trends of our members.

(more…)Since claims and loss control expenses take nearly 70% of every premium dollar, most of what you hear from MTM is about how to reduce accidents and when an injury does occur, how we manage each claim dollar in the most effective way possible. With that said, MTM conducts an audit each year when each workers’ compensation policy expires. To complete these audits, we have used an outside audit service and many of you will recognize Aprise as the firm that visited your shop or conducted your internal email/phone audit. They have done an excellent job, however COVID changed the audit process significantly by greatly increasing the number of audits that were done by email/phone with the number of field audits considerably lower. When the audits are processed internally by email/phone, it appeared that that process could be handled at a reduced cost by MTM staff. We conducted a research project and determined that somewhere between $80,000 to $120,000 of savings could be realized by moving this to an in-house function. On August 1st, we implemented a gradual conversion to an internal MTM process. Many of you know Glenda Moyle, Premium Accounting Manager who has been producing audit invoices and processing the collection of MTM audits for more than 40 years. In the past, she would send the audit paperwork to Aprise to conduct a field audit or an email/phone audit. Glenda’s function is unchanged. What we have changed is that the audit assignments will be done internally, and the internal email/phone audits will be conducted by MTM staff. We will still use Aprise when a field audit is the appropriate audit method.

On August 1st, we implemented the program and got the conversion underway with the goal of being fully converted by 12/1. With good procedures in place, forms and management support, this conversion has gone very well and with the large number of members in January you’re likely to see correspondence from the MTM Internal Audit Associate, Faris Saleem.

In the meantime, one of the important parts of this project is to make sure that you know that we take the stewardship of MTM premium seriously. We are always looking for ways to reduce our costs, which increases the dividend value for our members. With the MTM Board of Directors made up of 11 shop managers, that remains a primary focus from the Board to the President and to the employees of MTM.

Until next time, have a wonderful fall.

June 30 – a good time to review our results and see if we are on target or if we need to make adjustments to reach the company goals. An important part of that review is a study of claims losses. Insurance claims are the primary driver of financial results. No other expense category comes close to the percentage impact of claims loss payouts.

Our June 30 review looked at the first six months of 2022 and compared it with the current six months of 2023. We will want to review the differences and see if there are any trends that can be identified. In looking at the aggregate loss payments for 2023, we found those were higher than both 2022 and 2021. We pulled 2021 into the review to see if any trend lines could be identified. Interestingly, we found the claims frequency has remained virtually unchanged for 2023 compared to 2022. The frequency difference was 1%.

(more…)Every time I think about a busy time at MTM, I remember many of my recent visits to our MTM shops. Our members are undergoing massive changes all the time. There are shortages of raw materials. There are shortages of personnel. The changing product line and the markets in which they serve all create a tech environment where every minute of the day is filled with important decisions. That always helps me keep a perspective for the busy times that MTM has. February is one of those extraordinarily busy times.

In actuality it starts the last couple days of January when Chris Doebler, MTM CFO, and Megan Brown, VP of Sales and Marketing and I meet with our actuarial team to discuss year-end results and loss reserves. It is a lively discussion/debate where we take many unknowns of future medical costs, future court decisions, and try to apply that to the over 500 open claims that we are presently working on. Once an agreement is reached for that, then we start plugging those into the expense categories and revenue of 2022 for a final financial statement. All of that needs to be completed in just a few days. On February 9th we presented our findings to the MTM Board Finance Committee and MTM Board Marketing Committee. These committees are made up of MTM members.

(more…)Every time I think about a busy time at MTM, I remember many of my recent visits to our MTM shops. Our members are undergoing massive changes all the time. There are shortages of raw materials. There are shortages of personnel. The changing product line and the markets in which they serve all create a tech environment where every minute of the day is filled with important decisions. That always helps me keep a perspective for the busy times that MTM has. February is one of those extraordinarily busy times.

We made it through the holidays. And Michigan winter is finally upon us. So is the closing of calendar year 2022. The MTM midyear actuarial review and subsequent monthly loss reviews are encouraging for our ninth MTM annual dividend in a row. That’s the preliminary good news. This is always a stressful time for me. We have had a good year so far, we are waiting to close the year with hopefully no large shock losses, and then we work with our actuary on the final loss numbers for the year. This year the normal year end closing stress is a bit higher. Remember that we moved the annual member’s meeting from October to early March. Traditionally at the October meeting we have given a brief synopsis of how the year looked through 9 months. It was always an estimate since there were still three months to go and large surprise losses can happen. However, this year with the annual member’s meeting in March, we won’t be giving you an estimate, but we’ll actually be giving you the year end result. As I have mentioned in an earlier newsletter, if all goes to plan we will have a great speaker, a great meal, and then hand out member dividend checks. Talk about pressure—however you can help—using your loss control skills and the MTM loss control team please do all you can to close out the holiday season with minimal losses. It’s good for your workers, it’s good for you, and it’s good for your dividend calculation.

(more…)In the last MTM newsletter I announced that MTM management and Board decided to move the traditional annual members’ meeting from October to March. The goal was to try a different time of year in hopes of improving turnout among members. One of the draws besides great speakers and meeting other MTM shop owners would be that in March we will know final yearend results. What a nice enhancement to the members’ meeting, instead of talking about a possible members’ dividend we hand out members’ dividend checks.

(more…)About eight years ago, MTM management thought that getting an outside rating agency valuation of MTM would be helpful to the Board of Directors and MTM members. At that time, management felt confident about our results and financial integrity, however, having an outside agency conduct their own independent evaluation would be a proof source of what management was telling the Board of Directors and members. We chose an outside rating agency called Demotech. Demotech had over 30 years of small and mid-size insurance company rating evaluations, and was a known standard for insurance company evaluations. We proceeded down that path and received an “A, Exceptional” rating from Demotech. About three years later, we received an upgrade from Demotech one step higher to “A Prime Unsurpassed.”

Even with our Demotech rating, occasionally questions arose because the rating agency used by large insurance companies is a company called AM Best. AM Best is actually an individual’s name, Alfred M. Best, who started insurance company ratings over 100 years ago. AM Best specializes in large companies, but because of its history it remains the world gold standard for insurance company ratings.

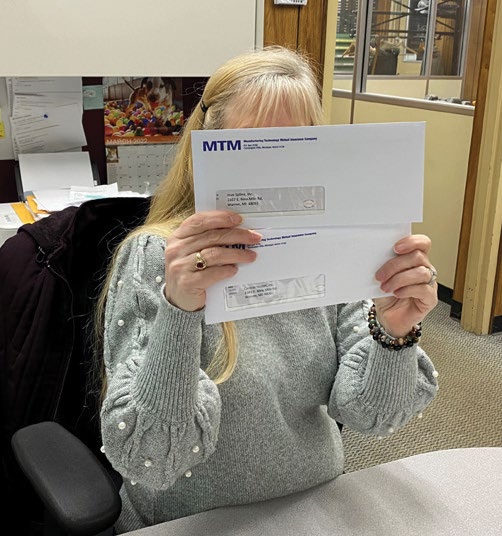

(more…)Well, this will be an unusually short article. Why – because the montage of enclosed pictures tells the story better than I can. Hundreds of shops getting checks. I met MTM members I have called upon for 8 years. I met some long term members, some new members that I had not visited before. To speed the delivery process my thanks to agents who agreed to deliver checks, to MTM Loss Control staff who worked for 3 weeks delivering checks in-between Loss Control visits and to Megan Brown, VP of Sales who is the fastest driver of the delivery team. The goal was to get the money to MTM members in three weeks. A check gift is not nearly as attractive if delivered in 6 or 8 weeks. In a few locations, some checks were delivered by mail. Our least preferred delivery method. Most checks were delivered by a real person delivering to a real customer.

I hope you enjoy the pictures. A couple comments on pictures: Some MTM members (mostly ladies) are camera shy. Their comments: Really, I have to take a picture? Some of the pictures show the steps these ladies will go to, to avoid a picture. Notice the check covering the face one. Notice the robot holding the check vs the office manager. You get the drift.

Delivering $4,000,000 is very fun. Let’s do it again next March.

Thursday morning, February 17th, the MTM Board met to review the recommendations from both the Board Marketing committee and the Board Finance committee. Those two committees do a preliminary review of financial results, and also structure the MTM member dividend program. At the end of the Marketing committee, a recommendation was made to the full Board for the parameters of this year’s dividend program. The following week, the Board Finance committee met to review the actuarial loss report, and the financial information provided by MTM management.

(more…)With the fiscal year closed, Chris Doebler our CFO has been working long hours to put the 2021 loss and financial reports for our independent actuarial team together. At the end of January, Chris and I meet with our lead actuary to review the 134-page report on the year’s loss results. Lots of detail reviewed with evaluations completed with multiple methodologies. Predicting the future value of 2021 claims that recently happened and how prior year claims are being presently handled today is as much an art as it is a science. On January 31, the actuarial team, Chris and I all agreed on the 2021 “loss numbers”. Now we quickly plug those into the financial statements for profit review.

From an overall loss review, a few findings are apparent. The 2021 year was not a get back to “normal” year that we all had hoped for back in January 2021. The COVID disruptions were different than 2020, but still a significant factor in our business and personal lives. In aggerate our members activities grew for 2020, but not back to 2018 or 2019. Maybe this slower pace contributed to a reduction in frequency of severe losses. We had no fatalities in 2021 and fewer severe losses such as amputations. That is the good news. On the bad news side, we saw an increase in losses for new employees (90 days or less). Training was an issue in nearly all these cases. We understand the pressure to produce product and get the new employees in the production process. From our accident reviews, training and supervision of the new employees is a shop challenge. While it is most challenging to take the time to train in today’s world, I can report firsthand that a serious injury is the surest way to stop all shop production. It is important to the shop’s success that we send the employee home in the same condition as they arrived in the morning.

Our Loss Control staff is focusing on that issue for our members’ benefit. My task for the next couple weeks is to work the members’ dividend through the Board Marketing, Board Finance, and then full Board meetings. Our goal is to finalize MTM members’ declaration before February 17th and then manage the print and reporting process for deliveries to begin March 1st. In the meantime, you can help our next year’s dividend by paying special attention to your newest employees.

Be safe and see you soon. – John

Late Friday afternoon, December 31st, we closed the 2021 financial year for MTM. As we get close to the end of the year, management’s concern always increases. We have a good year and hopefully nothing happens in the last week, two weeks or month that would harm the good year that was already on the books. I’m pleased to report that no large claims occurred in the last week and month. December loss ratio looks good and that is attached to a good loss ratio year for 2021. While we have our raw loss numbers, we send our loss data for an independent actuarial review which is completed in January. This process is detailed.

(more…)Normally each month I update you on changes in workers’ compensation law, operating environment, MTM news or questions I have recently received from members. An important item, that I should inform you about is how to we manage the money MTM members entrust us with. That ties into a very common question, tell me about MTM’s financial security. MTM is NOT a billion dollar national insurance company. We ARE a mutual insurer owned by 941 Michigan employers. One can argue that there is more stability in these large international companies, but events over the last ten years have shown that large does not necessarily mean stable. Financial stability also factors into how the MTM Board of Directors review our annual members’ dividend. Over the last seven years, the MTM Board of Directors has returned $27 million dollars as owner member dividends. That equates on average to 30% of the annual premium. Dividend payments starts with financial stability. It does not do any good to return monies to member owners only to say that we’ve come up short and need more money to pay claims. So while the dividend part of the member equation is critical, making sure that the financial stability of MTM comes first.

(more…)On Monday, March 22nd, I completed my deliveries of the 2021 dividend checks. As a refresher, the MTM Committees and Board of Directors met in February to review the profits from 2020 and then decides how to spend those profits. As has been the case for the last six years, the Committees and Board of Directors, which is made up of shop owners, shop CFO’s, and administrative managers, decide quickly to return the profits to the MTM Member Owners. That has been the consistent answer for the last six years. This year, the Board declared a dividend of $4.5 million. There was actually three parts of that dividend declaration:

For me and the MTM Management Team February is a very busy time. During the first week, we work with our outside actuary to determine profit for the year. This is done by evaluating current report losses, development of existing losses over the future, and estimating losses that we may not yet be aware of. Once the loss evaluation is completed our CFO, Chris Doebler puts together the year-end financial statements. Then on February 4th we have a meeting with the MTM Board Marketing/Underwriting Committee. This committee is made up of 8 shop owners, CFOs, and plant managers. Management presents a dividend recommendation for them to adopt or amend for 2020 results that is paid in March.

On February 11th, the MTM Board Finance Committee met to discuss the financial condition of the company based on the 2020 financial results, evaluate the MTM members dividend recommendation and determine what changes they would like to see. The Finance Committee is also made up of 8 member owners.

(more…)By Chris Doebler, CPA, Chief Financial Officer

In spite of everything that has happened over the last few months the finances of MTMIC remain stable. At the May meeting of the Board of Directors management reported that we could anticipate a drop of as much as 15% in annual premiums earned. Now as we near year end it appears that the expected drop could very well be 5% or less. Although net income appears to be lagging last year’s figures, barring a significant drop in premiums or increase in claims we should be on target for yet another member dividend in March 2021.