Experience Mod Calculation

It’s been some time since I wrote about Michigan workers’ compensation experience modifications and how they affect your workers’ comp premiums, so, it seems time for a refresher course. Experience modifications in Michigan are promulgated out by an outside rating agency that requires membership from all Michigan insurance companies. We submit to them data on every policy six months after it expires. We report payroll by class code and losses for every employer

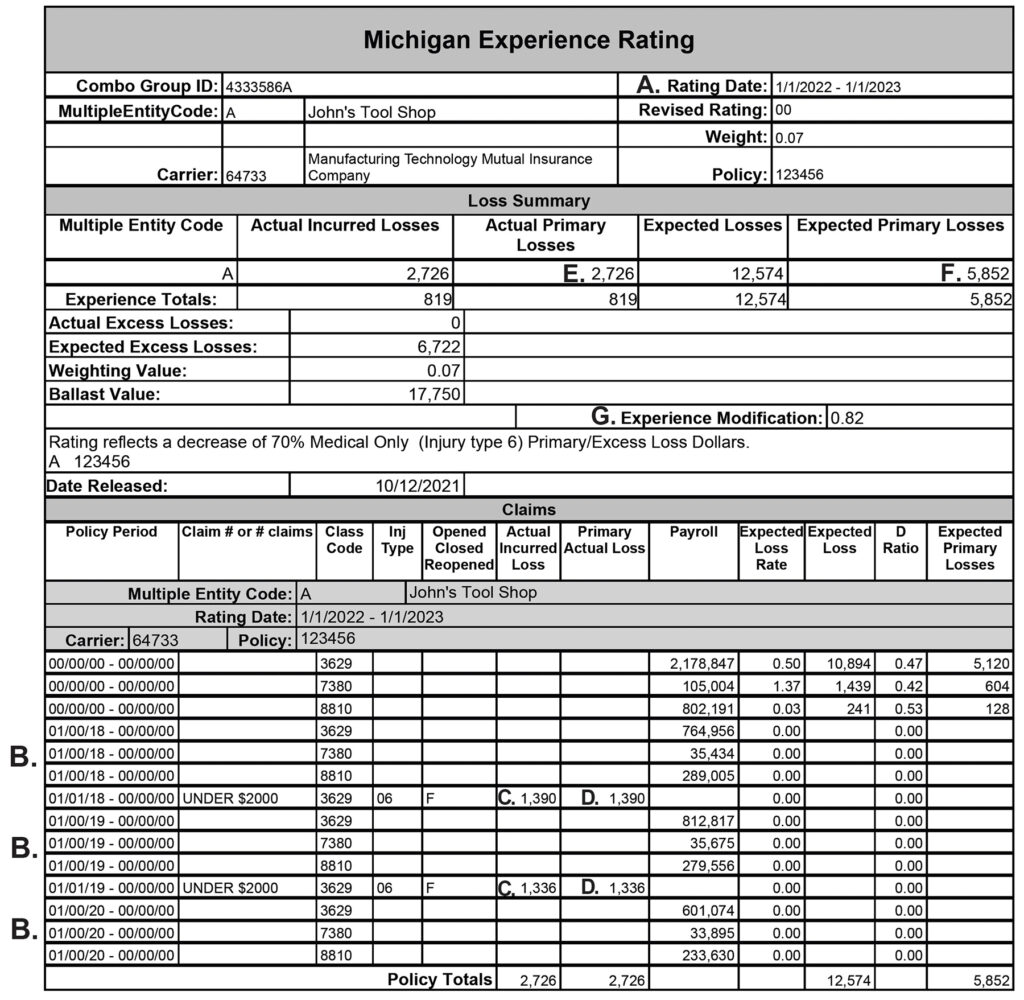

This agency then produces an individual experience modification that is used by all insurance companies. To better walk you through this process, I’ve attached an exhibit with some letter designations for certain sections. Here is a simple explanation of the entire calculation.

The first step is to notice that the data next to A. shows the experience mod rating date. In this case it will be 1/1/2022 through 1/1/2023. It is custom made for every Michigan employer based on their own data compared to “expected statewide” loss data by class code. I’ll explain more on that in a minute. If we go to letter B., we can see for this rating year is 1/1/2022 to 1/1/2023 the data includes payroll/loss years of 1/1/2018 to 1/1/2019, 1/1/2019 to 1/1/2020, and 1/1/2020 to 1/1/2021. The most recent year is skipped since the data is not yet reported. Simply put, the losses of the last four years, not including the most recent year, are being used in the calculation. Under item marked C. the loss summary by year is shown. This shows the actual incurred losses. If a loss is reserved and open, it’s included at the most current reserved amount. Letter D. shows what is titled as the Primary Actuary Loss. The rating bureau formula penalizes an employer for frequency versus severity. The maximum loss shown is for $18,000. So, if a member has a claim for $40,000, $18,000 is shown under item D. and the excess is shown in a category that we’ll talk about in a moment.

The idea is that severity is not as predictable as frequency. Using this logic, someone that has one claim for $36,000 has much less impact than an employer that has two $18,000 claims. Again, the focus is to penalize frequency versus severity. Loss amounts over $18,000 are reduced by nearly 90% so while there is an impact, the impact is only 10% of the claims value over $18,000. In this case, an item marked E. shows the actual primary loss for three years. And the letter F. shows what those losses are from an expected value. The payroll is multiplied by the class code expected loss and an average is then determined. This is finalized under item G. where the final experience mod is calculated. The idea is that 1.00 is what would be expected for the given payroll and losses for any given employer. If the experience mod is below 1.00 the loss experience is better than expected for the payroll and class code. If the mod is above 1.00 then the loss experience for this employer is worse than expected.

In our over 900 shops, I can tell you the experience mod range is very wide. We have some employers where the experience mod is below .60. That is before anything is done, the manual rate is multiplied by .6 for an immediate 40% discount. That discount is based solely on the individual employer’s loss experience. On the high side, we have a handful of members where the experience mod is above 2.50. This means that the employer is paying two and a half times the manual rate for the same workers compensation coverage.

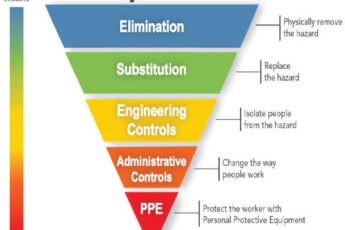

There are some more details there. You’ll see additional numbers of actual excess losses, expected excess, weighting values, ballast values, etc. There are other categories that fine tune the experience mod. However, the simplest way to look at it is losses that are paid for workers comp ultimately get included into your workers comp experience modification worksheet and effect the premium that you’ll pay – not immediately – but one year after they occur they will show up on this experience modification worksheet. This is one of the reasons we at MTM put so much value in Loss Control. If we can reduce or eliminate losses from occurring, they do not show up on the experience mod worksheet and our employer saves money. The same thought process goes into your MTM dividend. The better we can make your loss experience, MTM has more dividend money to send to the member shops.

For anyone that would like more detail or has questions on this, I encourage you to either email me or give me a call. We are happy to help our members understand this important rating factor and how we can best lower the cost for our MTM members.

I hope you’re enjoying the summer and I look forward to writing more soon.